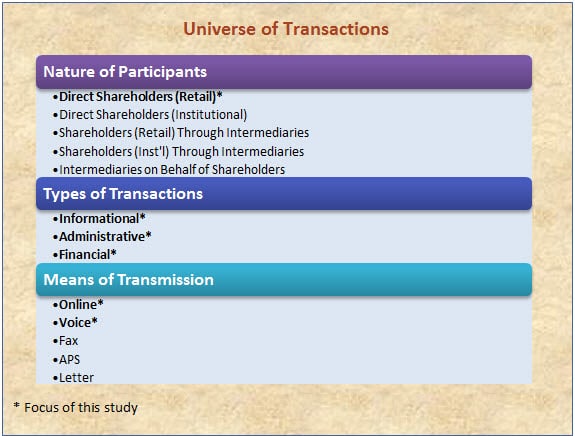

In developing risk management approaches to shareholder authentication, fund groups may find it helpful to consider, among other questions: who has responsibility for authenticating shareholders in given transactions, what is the level of risk (i.e., the financial exposure) to the fund groups if such transactions are fraudulent, and what measures should be taken to reduce the potential risk of such transactions. Addressing these questions can, in turn, involve categorizing shareholder transactions by:

- the nature of participants involved in shareholder transactions

- the types of transactions, and

- the means of transmission of the transaction requests.

In implementing risk management approaches to shareholder authentication, fund groups must assess and balance sometimes competing considerations, including the security level to be achieved, the degree of inconvenience that different measures may impose on shareholders, and the costs of various authentication-related technologies and systems. Where this balance is struck may depend, in part, on a fund group’s assessment of the relative risk associated with the particulars of the transaction at issue.